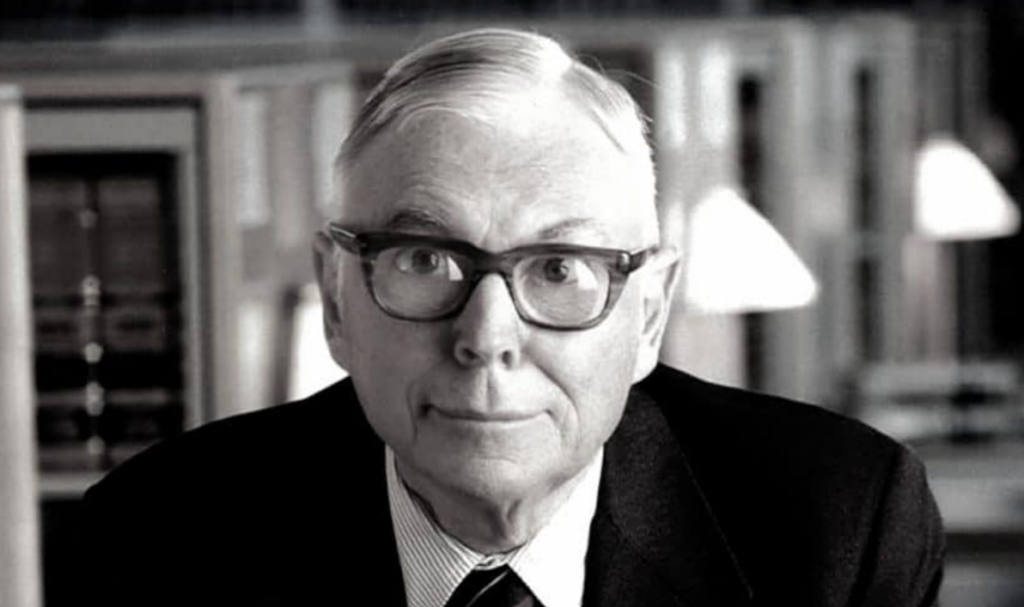

Charlie Munger, long-time business partner of acclaimed investor Warren Buffett, currently has an estimated net worth of $2.2 billion at the incredible age of 99. That makes him one of the oldest billionaires in the world. Munger is still actively engaged in investing and finance as the Vice Chairman of Buffett’s holding company Berkshire Hathaway. His journey to accumulating massive wealth over his long career is an inspiring one for investors of all ages.

From Humble Beginnings to Harvard Law

Munger had modest beginnings growing up in Omaha, Nebraska. His father, Alfred, was a prominent real estate lawyer who invested early on in consumer businesses like Coca-Cola. He later became a federal judge appointed by President Herbert Hoover. His mother, Alta Driscoll, was a housewife and attorney herself before deciding to focus on raising Charlie and his younger siblings as her husband’s career took off.

Young Charlie worked various jobs growing up like selling magazines door-to-door and clerk positions at his grandfather’s grocery store. He eventually enrolled in the University of Michigan, where he dabbled in courses ranging from meteorology to philosophy to accounting. His eclectic academic interests reflected an innate curiosity present from childhood. He ultimately chose mathematics as his focus given his strength in analytical reasoning.

After earning his undergraduate degree, Munger served three years in the U.S. Army Air Corps where he achieved the rank of second lieutenant. Following his honorable discharge, he took advantage of the GI Bill to enroll in Harvard Law School, graduating magna cum laude with his Juris Doctor degree in 1948. The educational pedigree he burnished at elite institutions would lend credence to the intellectual reputation he strove to build over the ensuing decades.

Early Career Investing While Building a Law Practice

After graduating from Harvard Law, Munger moved back to Omaha and joined his father’s law firm at the age of 24. As he built up a successful legal practice over the next decade, he also began laying the investment framework that would prove instrumental to amassing his fortune. He formulated his approach during hours spent perusing investing-focused publications at the Omaha Public Library as well as financial filings in his father’s office. Munger gradually grew his investment capital through various ventures like real estate development projects and speculating in commodity futures.

His early investing experience convinced him that real, sustainable wealth came not from speculation or timing markets correctly but rather identifying and holding high-quality assets and superior businesses for long periods. This buy-and-hold investing philosophy aligned perfectly with partner Warren Buffett’s own orientation, even if Munger lacked Buffett’s singular early focus on stocks. Nevertheless, Munger’s interest in constructing an integrated analytical framework drawing on multiple disciplines to assess investment opportunities also proved foundational to the near-unparalleled success the two would later attain together.

By 1959 Munger has grown disillusioned practicing law, finding it difficult to muster energy solely for clients’ mundane legal issues. He informed his father of plans to leave the law firm and Omaha behind for the burgeoning opportunities he saw blossoming in California. Though his father urged him to reconsider, Munger remained determined to head west and channel his passions into investing full-time.

Investing Partnership With Warren Buffett

The move to California proved momentous when Munger’s passion for investing eventually brought him into Warren Buffett’s orbit. After experimenting with a variety of businesses like real estate and trade publishing, Munger determined that investing was his true calling. He launched an investment partnership in 1962, incorporating under the name Wheeler, Munger & Company. The early years proved extremely lucrative as he compounded capital at over 60% annually. Munger’s ascent caught the notice of other savvy investors on the west coast, including Charles T. Munger—no relation but an established money manager based in Los Angeles.

The elder Munger reached out upon hearing that the two shared more than just a surname. Recognizing a fellow student of legendary investor Ben Graham, he suggested his younger namesake get in touch with Graham’s most famous former employee—a rising investor named Warren Buffett who was running his partnerships out of Omaha. Munger was of course already familiar with Buffett’s stellar 13-year track record but welcomed the introduction.

The two men connected immediately after that initial phone call in 1959. Both were students of Graham’s teachings, though Munger had evolved a more interdisciplinary perspective on investing. They also shared the same long-term outlook favoring durable, easily-understandable businesses available at bargain prices instead of chasing short-term price movements to maximize profits. Their investing philosophies aligned so closely that they began comparing deals and informally advising each other on opportunities.

Over the ensuing years Munger dissolved his own partnership to invest in Buffett’s, which was scaled up relative to his own. Buffett eventually dissolved his partnerships in 1969 upon taking control of struggling textile-maker Berkshire Hathaway and transitioning it to a holding company for the various stocks and businesses he controlled. But it was during that volatile stretch of the late 60s that Buffett’s and Munger’s fates grew intertwined beyond separation. The two men relied heavily on each other for investing ideas, business partnership opportunities, and personal support as professionals during a turbulent economic climate.

While Munger retained autonomy over most of his interests under the umbrella of Diversified Retailing Company he formed in 1971, his identity became increasingly linked to Buffett’s. He began investing heavily in Berkshire Hathaway stock during this stretch as well as personally convincing Buffett to invest in assets like The Washington Post Company and Coca-Cola years before they multiplied into legendary winners for Berkshire shareholders. By 1978 Munger officially joined Berkshire’s board, adding capital allocation oversight and strategic input to a role he served informally with Buffett since the 1960s.

Riding Berkshire’s Rise to Unfathomable Riches

As Munger’s own net worth rose steadily through the success of his investment partnerships in the 60s and 70s, that personal fortune exploded in value thanks to Berkshire Hathaway. Munger convinced Buffett to invest over $1 billion in Coca-Cola by 1988—over 30% of Berkshire’s portfolio at the time but an investment viewed as carrying incredible risk. Of course that investment returned exponentially for Berkshire in the succeeding decades as both Coke and the consumer staples sector powered ahead.

Munger deserves ample credit for pushing Buffett to bet so heavily on consumer brands as mainstays in people’s everyday lives back when Berkshire’s portfolio remained dominated by financial and industrial stocks. Munger also performed invaluable service for decades running key Berkshire subsidiaries like clothing maker Fruit of the Loom and home furnishings company Wesco Financial Corporation which were acquired in cash-stock deals. Munger ensured these wholly-owned businesses were aligned with the Berkshire culture revolving around decentralization, efficiency, and honesty.

Moreover, Munger made his mark in negotiations and structuring the actual acquisitions and equity deals responsible for so much of Berkshire’s transformation from a struggling New England textile mill to the modern conglomerate it represents today. Using shrewd tactics like equity-for-stock swaps and auction scenarios to leverage Berkshire’s reputation and financial advantages over sellers, Munger saved untold tens of billions for Berkshire over the years that went directly into expanding its vast portfolio.

The unparalleled growth at Berkshire in the ensuing decades, fueled by Buffett’s legendary investing acumen and Munger’s own substantial contributions, vaulted Munger’s personal fortune ever higher based on his equity stake in the company. That stake surpassed 49% of Berkshire in 2022 even after Munger donated enormous sums to varied charities over the preceding decades. Despite shedding billions regularly to philanthropic causes, Munger has seen his Berkshire shares swell from their original $265 per share price tag in 1977 to north of $300,000 today. Even adjusted for Berkshire’s subsequent stock splits, that translates exponential growth factoring into the billions.

Outspoken Public Image Paints a Complex Picture

While Munger has accumulated the bulk of his vast wealth outside public consciousness, his statements to the business media over the years have painted the image of a man with complex perspectives not aligning neatly to one ideology. On economics and public policy, Munger purports beliefs that superficially strike observers as conservative or even reactionary: He rejects concepts like modern monetary theory, opposes wealth taxes, and blames welfare states’ generous benefits for weakening citizens’ drive.

Yet when delving deeper into rationale over rhetoric, Munger shows less outright animosity for left-leaning policies like single-payer healthcare or redistribution schemes then strict conservative dogma would predict. He functionally acknowledges a role for government intervention in instances where capitalism exhibits shortcomings, albeit through technically regressive policies like a value-added tax (VAT) versus outright wealth confiscation.

On the culture wars, Munger again throws observers curveballs with sentiments that, while direct, bounce between sympathy for marginalized groups to boosting meritocracy for its focus on individual potential. He acknowledges “wretched excesses” and “irrationality” birthed from capitalism while defending free-market meritocracy as society’s most “practical” system for raising absolute living standards long-term. He also stresses thrift, creativity and self-reliance even among capitalism’s vulnerable instead of reliance on either collective action or government assistance to overcome one’s circumstances

When not jousting on policy, Munger the man similarly reveals unflattering touches for someone enjoying such material success. He mocks academic economics yet praises fields like engineering and hard sciences. He laments modern business education emphasizing leadership, teamwork, and diversity over individual skills and integrity. He disdains psychology as a “soft” discipline compared to “real” sciences like physics. While Munger has always stressed the intellectual virtues of multidisciplinary synthesis over narrow specialization, his rhetoric on academia often strays toward elitism downplaying fields delivering life-changing impact daily.

Between those harder academic pursuits though lies Munger the voracious reader whose range spans fiction, biographies, economic history and more. Someone equally comfortable quoting Hemingway, Gandhi or his favorite investor Benjamin Graham has layers not easily pinned down. Ultimately Charlie Munger contains multitudes—archetypal self-made American elite, yet fierce critic of the capitalist system lifting his social status. Philosopher, vulgarian, iconoclast, curmudgeon…all those labels somehow apply to a singular man as intellectually versatile as he is financially successful.

Unwavering Focus on Long-Term Investing Philosophy

No matter one’s opinion on the assorted controversies associated with Munger over his decades in public life, he deserves recognition for his philosophical consistency regarding investing and money management. He has preached since the beginning of his career as an investor the importance of identifying enduring, high-quality companies that can compound capital long into the future.

This “buy right and hold tight” approach centers on avoiding overvaluation for growth’s sake and instead focusing relentlessly on business fundamentals likely to persist despite evolving consumer trends. Competitive advantages, capable management, favorable growth runways and clarity into future cash generation receive premium emphasis. By contrast, escaping price volatility through endless wheeling and dealing attracts no priority. Munger has blasted speculators focused on chasing ephemeral share price movements for quick profit. Such short-term gambling has no place in Munger’s carefully constructed mental models honed since early adulthood.

The bedrock of that clinical approach relies on cultivating what Munger terms “worldly wisdom” and the multidisciplinary mindset to nurture it indefinitely. This means observing reality through an economic lens, yes, but also informed by psychology, mathematics, science, history and other models as means of overcoming biases sabotaging most investment decisions. Adaptability matters greatly too—markets continuously evolve and assumptions forever change. Investors therefore must update mental frameworks constantly as new information emerges. But the timeless principles of rationality, objectivity and fundamentals-based probability assessment serve as anchor even amidst external chaos.

Munger refined for decades this clinical framework for identifying value Selecting winners like Coca Cola or American Express decades before they emerged as international titans required that disposition and temperament. While critics point to Berkshire’s Apple investment coming late once the tech giant’s dominance solidified, Munger cares little for vindication and accepts uncertainty inherent in predicting future champions. By ignoring dejected assets until their fundamentals improve, huge winners for Berkshire frequently came from the unlikeliest places—candies, furniture, underwear, bricks, etc.—because both men ignored popular narratives.

This discipline in tuning out frothy speculation for cold logic explains in large part how Munger built such enduring personal prosperity even if less glorious than partner Warren Buffett’s. But for Munger, the methodology matters more than admirers or fortune. Despite achieving billionaire status long ago, the lessons he’s refined over nearly 70 years represent the legendary investor’s ultimate legacy.

Final Years Still See Legendary Investor Focused on the Future

As Munger celebrates his 100th birthday in January 2024, no signs indicate the legendary investor and thinker extraordinaire shows any intention of resting on his laurels. While other men of comparable wealth, age and stature might retire to enjoy philanthropy and legacy preservation, Munger appears as intellectually engaged as ever with capital allocation and big-picture policy issues.

He still maintains an active role advising Berkshire Hathaway and longtime partner Warren Buffett through frequent conversations and publicly representing the conglomerate at its famous shareholders’ meetings. Munger also continues serving on the influential board of Chinese electric carmaker BYD, where he bridges cultural gaps between management teams thanks to years building relationships with Asian industrialists. Munger displays little reluctance riffing on assorted economic issues whenever the mood strikes too.

Despite surpassing his 97-year old business partner’s own managerial involvement lately, Munger entertains no succession speculation. As long as Munger continues demonstrating such vigorous determination upholding Berkshire’s principles for capital stewardship, his stake seems guaranteed. That stake also practically guarantees Berkshire remains a speculative target for acquirers hungry to gain its subsidiaries and investment holdings under one roof after Buffett’s own passing. But with his successor continuing alighting fires well into supposed retirement age, the Oracle of Omaha’s legacy looks safer than ever, thanks in large part to his Oracle of Los Angeles.

And even if Munger dedicated his elder years solely to his beloved causes like academia, architecture and public policy, such diverse passions promise keeping him profoundly engaged for however long he continues gracing the world with his presence. After carving his own identity over seven decades in finance to ascend beside Buffett into mythical status, Charlie Munger has earned the right to spend his final seasons however he damn well pleases. But for a man wired relentlessly toward advancing civilization through capital allocation, the projecting investing seer indeed shows no signs of surrendering his post battling the multitudes of madness. Not when there’s still so much wisdom left to collect and dispense.