How To Receive International Payments in Nigeria

In today’s globalized world, receiving money from abroad has become quite common for various reasons. Whether it’s friends and family helping out, freelance work, or business transactions, international payments play an important role in the economic activities of many Nigerians on a daily basis. However, actually getting paid from overseas has traditionally been inconvenient and time-consuming due to difficulties associated with traditional banking methods and restrictions.

Thankfully, recent advancements in fintech have revolutionized the cross-border payment landscape by introducing faster, safer, and more affordable digital solutions. From remittance apps to virtual accounts, a whole new world of possibilities has emerged for receiving international funds directly in Nigeria. In this comprehensive guide, we examine the top 5 best ways to receive payments from abroad utilizing these innovative fintech platforms and services available in 2024.

Current Challenges with Traditional Methods

Prior to digitalization, wire transfers through brick-and-mortar banks were about the only viable option for receiving cross-border remittances in Nigeria. However, this process generally involved a number of hassles like long queues, high fees, currency conversion losses, and delays in receiving cleared funds.

Additionally, certain banks could refuse international payments if senders’ countries were considered ‘high-risk’. Recipients also needed to maintain bank accounts, presenting difficulties for the unbanked population. Overall, these legacy infrastructure inadequacies discouraged greater economic participation in the global marketplace for many Nigerians.

Emergence of New Digital Alternatives

Thankfully, the fintech revolution has brought a wave of disruptive solutions rewriting the rules of cross-border money movement. Trailblazing startups leveraged expanding mobile connectivity and online payment rails to bypass traditional intermediaries, delivering a far superior user experience at lower costs.

Remittance giants like Western Union facilitated partnerships while specialized cross-border payment platforms like WorldRemit and TransferWise emerged. The advent of virtual banking, stablecoins, and decentralized exchanges further augmented the options available for receiving international funds digitally in Nigeria.

Top 5 Methods for Receiving International Payments in Nigeria

After extensive analysis of platforms, features, user reviews, and other parameters, here are the top recommended ways to receive global money in Nigeria effectively in 2024:

- Remittance Services

- Gift Cards

- Domiciliary Bank Accounts

- Cryptocurrency

- Digital Cross-Border Payment Apps

Let’s explore each option in detail:

-

Remittance Services

Pioneers like Western Union and MoneyGram laid the groundwork for digital remittances through extensive retail networks. Users can now receive funds via their Nigerian agents/partners after online sending from abroad within 1-5 business days on average. While associated fees apply, their ubiquity, reputation and worldwide reach maintain relevance.

-

Gift Cards

Instead of traditional wires, senders purchase discounted store/platform gift cards which recipients redeem or sell locally at Nosh. This method avoids conversion costs, crediting instantly upon email delivery. Cards from Amazon and Google Play enjoy Nigerian demand popularity.

-

Domiciliary Bank Accounts

Reserved foreign currency accounts allow direct credits from global partners. After setup, users receive notified deposits exposing little to no exchange layer. Banks like Zenith and Access offer this solution professionally for large remittances.

-

Cryptocurrency

Popular payment coins like Bitcoin and stablecoins permit rapid, permissionless value transfers into Nigerian crypto wallets. Funds retain optionality via holding or exchanging locally at lower spreads than traditional routes. Exchanges like Binance facilitate.

-

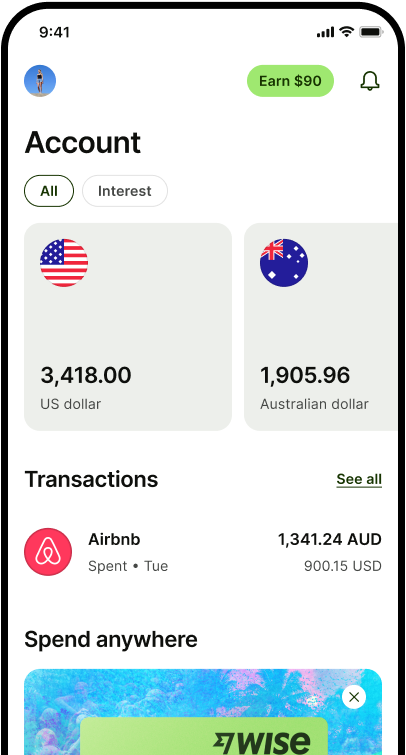

Digital Cross-Border Payment Apps

Tailored fintech platforms streamline international payments through virtual accounts. Examples include Payoneer, WorldRemit and Flutterwave Core, charging competitively while enabling convenient transfers to local bank accounts/cards.

How to Receive International Payments in Nigeria

Now let’s outline the general process across recommended methods:

- Register for the desired service, verifying the identity

- Provide recipient details like name, address, bank details

- Share handles/identifiers with the overseas sender

- Confirm received credit notification via app/email

- Access funds through associated withdrawal/redemption

Delivery speed, acceptance limits, and associated fees may differ but overall experiences optimize ease and security versus legacy alternatives. Proper research and due diligence select services that maximize individual needs.

Frequently Asked Questions

- Which are the most popular payment apps in Nigeria?

Leading options include WorldRemit, Flutterwave, Paystack, and Opay based on merchant usage and consumer sentiment evaluations.

- How long does it take to receive international payments?

Delivery timelines range from instantaneous (gift cards) to 5 business days maximum generally via remittances depending on the originating location.

- Can someone without a bank account receive payments?

Yes, via channels supporting cash pickup or wallet credits without needing underlying accounts. Examples include gift cards, selected remittance agents, and cryptocurrency transfers.

- Are crypto transfers to Nigeria taxable?

Currently, no clear policy directly addresses cryptocurrency tax rules in the country. Receiving coins largely remain untaxed unless realizing gains by converting back to Naira locally.

- What are the daily transfer limits on payment apps?

Restrictions differ by product but common receiving limits range from $300-3000 daily increasing to $5000-15000 monthly after extended verification typically.

Conclusion

In summary, the digitalization of cross-border money movement has created immense opportunities for Nigerians to securely and conveniently receive funds globally with ease. Whether through remittance giants, fintech payment startups or crypto platforms, today’s innovative solutions offer speed, broad access, and competitive pricing. With proper research, users can select optimum receiving methods maximizing individual needs and preferences in the new digital economy.